Investment strategy

Scent Inversión Libre, FIL is a quarterly liquidity fund that seeks to generate returns similar to or exceeding the world index.

To achieve this goal the Scent portfolio invests in 5 international management firms that have consistently managed to beat global markets over the last 15 years. With maximum alignment of interests and meeting ESG criteria.

Fund name:

Scent Inversión Libre, FIL

Assets under management (€):

94.298.538,42

NAV 31-ene-2025 (€)

22,905695

Administrator and depositary:

BBVA

ISIN Code:

ES0157799000

Bloomberg ticker:

SCINLIB SM Equity

Net asset value:

Monthly

Management fee (%):

1,00

Number of shareholders:

62

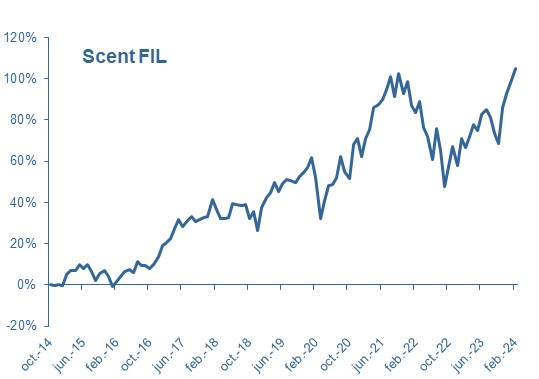

Fund return and market index

Statistical analysis

| Annualised return | 8,55 % |

|---|---|

| Last 12 months | 15,72 % |

| Accumulated return | 128,64 % |

| Best month | 10,87 % |

| Worst month | (12,93) % |

| % positive months | 63,64 % |

| Volatility | 14,29 % |

| Sharpe ratio | 0,58 |

Net monthly return (%)

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Year |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 6,95 | 6,95 | |||||||||||

| 2024 | 2,61 | 3,55 | 3,70 | (3,28) | 3,31 | (2,74) | 2,61 | 1,56 | 1,40 | (3,20) | 3,88 | (2,39) | 11,03 |

| 2023 | 8,29 | (2,56) | 3,09 | 3,55 | (1,64) | 4,25 | 1,32 | (1,91) | (4,46) | (2,64) | 10,42 | 3,57 | 22,11 |

| 2022 | (5,83) | (1,67) | 2,89 | (6,85) | (2,46) | (6,30) | 9,23 | (6,01) | (10,63) | 6,64 | 5,98 | (5,35) | (20,39) |

| 2021 | (4,97) | 5,42 | 2,35 | 6,09 | 0,87 | 1,29 | 2,57 | 3,23 | (4,89) | 5,85 | (4,84) | 2,97 | 16,08 |

| 2020 | 2,89 | (5,98) | (12,93) | 6,72 | 4,98 | 0,49 | 2,25 | 6,51 | (4,33) | (2,30) | 10,87 | 1,71 | 8,84 |

| 2019 | 8,68 | 3,40 | 1,96 | 3,37 | (3,13) | 2,65 | 1,34 | (0,40) | (0,58) | 2,03 | 1,37 | 1,54 | 24,09 |

| 2018 | 6,11 | (3,31) | (3,13) | 0,03 | 0,19 | 5,04 | (0,36) | (0,39) | 0,53 | (4,80) | 2,31 | (6,58) | (5,02) |

| 2017 | 4,60 | 1,08 | 1,64 | 3,86 | 3,42 | (2,52) | 2,34 | 1,39 | (1,89) | 1,06 | 0,45 | 0,55 | 16,90 |

| 2016 | (4,87) | 2,58 | 2,46 | 2,11 | 1,05 | (1,25) | 4,67 | (1,82) | 0,22 | (1,12) | 1,67 | 3,59 | 9,27 |

| Total accumulated return | 128,64 | ||||||||||||