Investment strategy

Investment aim: to generate moderate/high returns, approaching those of equity markets, albeit with a lower level of volatility and moderately correlated to risk assets.

Absolute Return: seek returns of 6%-8% over a three-year period, with lower volatility than equities and limit monthly losses to the 2%-3% range (not guaranteed). The aim is achieve better investment returns and risk compared to a mixed or balanced fund.

Multi-strategy: Long/Short, Corporate Events, Macro Global and Relative Value are the strategies to be combined. There is no predetermined exposure range to any of the strategies, though more liquid ones are favoured (Long/Short and Macro Global).

Fund name:

Prisma, FIL

Assets under management (€):

92.061.276,03

NAV 31-ene-2025 (€)

12,557010

Administrator and depositary:

UBS

ISIN Code:

ES0170814000

Net asset value:

Monthly

Management fee (%):

1,25

Number of shareholders:

27

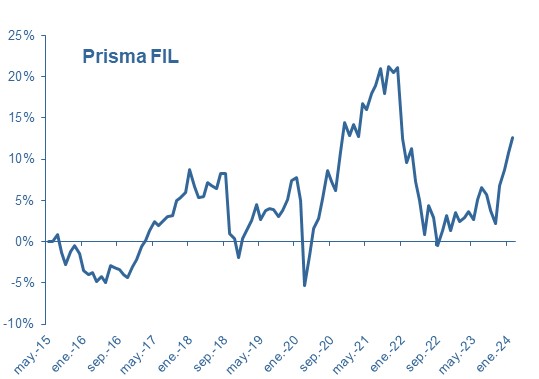

Fund return and market index

Statistical analysis

| Annualised return | 2,32 % |

|---|---|

| Last 12 months | 12,65 % |

| Accumulated return | 24,82 % |

| Best month | 4,48 % |

| Worst month | (9,78) % |

| % positive months | 58,26 % |

| Volatility | 7,53 % |

| Sharpe ratio | 0,28 |

Net monthly return (%)

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Year |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 3,14 | 3,14 | |||||||||||

| 2024 | 1,86 | 1,59 | 2,39 | (1,05) | 1,96 | 0,19 | 0,32 | 1,35 | 0,65 | (0,15) | 2,12 | (0,46) | 11,24 |

| 2023 | 2,20 | (1,10) | 0,50 | 0,68 | (0,89) | 2,32 | 1,42 | (0,77) | (1,81) | (1,58) | 4,48 | 1,90 | 7,38 |

| 2022 | (7,09) | (2,60) | 1,55 | (3,59) | (2,10) | (3,93) | 3,48 | (1,46) | (3,28) | 1,83 | 1,83 | (1,83) | (16,33) |

| 2021 | (1,37) | 1,18 | (1,27) | 3,52 | (0,65) | 1,75 | 0,77 | 1,80 | (2,58) | 2,82 | (0,57) | 0,47 | 5,82 |

| 2020 | 0,37 | (2,58) | (9,78) | 3,79 | 3,36 | 1,17 | 2,40 | 3,19 | (1,23) | (1,02) | 4,47 | 3,13 | 6,57 |

| 2019 | 2,28 | 1,27 | 0,91 | 1,90 | (1,78) | 1,17 | 0,12 | (0,06) | (0,88) | 0,81 | 1,19 | 2,22 | 9,46 |

| 2018 | 2,66 | (1,82) | (1,35) | 0,18 | 1,54 | (0,30) | (0,36) | 1,69 | 0,06 | (6,77) | (0,58) | (2,24) | (7,36) |

| 2017 | 0,84 | 1,60 | 0,82 | 1,14 | 1,16 | (0,53) | 0,58 | 0,52 | 0,11 | 1,77 | 0,37 | 0,48 | 9,20 |

| 2016 | (2,09) | (0,45) | 0,16 | (1,14) | 0,66 | (0,68) | 2,10 | (0,26) | (0,23) | (0,60) | (0,34) | 1,33 | (1,60) |

| Total accumulated return | 24,82 | ||||||||||||