Investment strategy

Investment aim: to generate moderate/high returns, approaching those of equities, with a lower level of volatility and moderately correlated to risk assets.

Absolute Return: seek returns of 6%-8% over a three-year period, with lower volatility than equities and limit monthly losses to the 2%-3% range (not guaranteed). The aim is to achieve better investment returns and risk compared to a mixed or balanced fund.

Multi-strategy: Long/Short, Corporate Events, Global Macro and Relative Value are the strategies to be combined. There is no predetermined exposure range to any of these strategies, though more liquid ones are favoured (Long/Short and Global Macro).

Fund name:

Adler, FIL

Assets under management (€):

40.342.188,18

NAV 31-ene-2025 (€)

15.596908

Administrator and depositary:

BBVA

ISIN Code:

ES0105984001

Bloomberg ticker:

ADLERIL SM Equity

Net asset value:

Monthly

Management fee (%):

0,50

Number of shareholders:

33

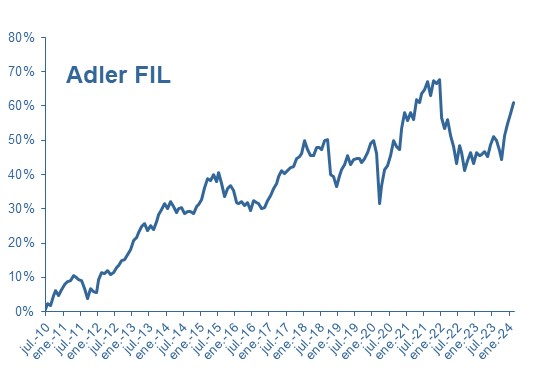

Fund return and market index

Statistical analysis

| Annualised return | 4,17 % |

|---|---|

| Last 12 months | 15,49 % |

| Accumulated return | 82,14 % |

| Best month | 4,90 % |

| Worst month | (9,92) % |

| % positive months | 62,29 % |

| Volatility | 6,80 % |

| Sharpe ratio | 0,58 |

Net monthly return (%)

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Year |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 3,38 | 3,38 | |||||||||||

| 2024 | 1,75 | 2,13 | 2,84 | (1,57) | 1,74 | 1,39 | 0,36 | 1,27 | 0,88 | (0,18) | 2,74 | (0,39) | 13,66 |

| 2023 | 2,28 | (0,67) | 0,32 | 0,65 | (1,00) | 2,42 | 1,41 | (0,79) | (1,86) | (1,79) | 4,90 | 2,35 | 8,29 |

| 2022 | (6,47) | (2,09) | 1,61 | (2,97) | (2,09) | (3,40) | 3,81 | (1,51) | (3,58) | 2,08 | 1,63 | (2,20) | (14,60) |

| 2021 | (1,49) | 1,46 | (1,28) | 3,60 | (0,51) | 1,62 | 0,74 | 1,44 | (2,52) | 2,86 | (0,62) | 0,65 | 5,93 |

| 2020 | 0,52 | (2,54) | (9,92) | 3,90 | 3,47 | 0,78 | 2,21 | 2,90 | (1,15) | (0,64) | 4,25 | 3,11 | 6,17 |

| 2019 | 2,41 | 1,31 | 0,89 | 1,86 | (1,83) | 1,08 | 0,19 | (0,03) | (0,81) | 0,91 | 1,13 | 1,82 | 9,22 |

| 2018 | 2,75 | (1,74) | (1,35) | 0,17 | 1,55 | 0,02 | (0,41) | 1,78 | 0,07 | (6,66) | (0,52) | (2,09) | (6,54) |

| 2017 | 0,90 | 1,67 | 0,95 | 1,49 | 1,26 | (0,61) | 0,70 | 0,68 | 0,04 | 1,77 | 0,39 | 0,50 | 10,16 |

| 2016 | (2,58) | (0,26) | 0,47 | (0,89) | 0,62 | (1,60) | 2,08 | (0,38) | (0,26) | (0,98) | 0,06 | 1,78 | (2,03) |

| 2015 | 1,17 | 2,71 | 1,93 | (0,59) | 1,26 | (1,29) | 1,72 | (2,28) | (2,69) | 1,76 | 0,68 | (1,14) | 3,12 |

| Total accumulated return | 82,14 | ||||||||||||